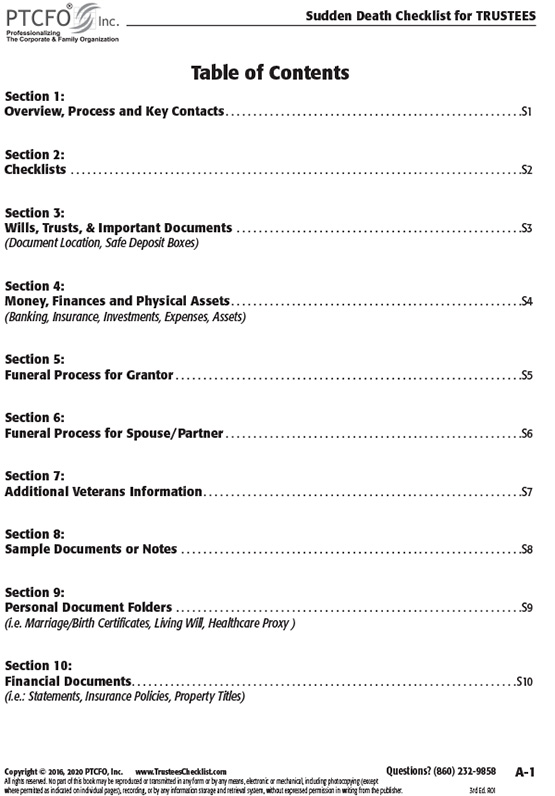

The Checklist in a nutshell

Overview, Process and Key Contacts

How to organize and store all of the important documents regarding the family trust as well as the administration and distribution of its assets.

Wills, Trusts, and Important Documents

How to organize and store all of the important documents regarding the distribution of the family's estate and its assets.

Money, Finance and Physical Assets

Access to income information, insurance coverage, bank account information, outstanding loans or debts, and all other physical assets of your estate.

Why use paper?

Hackers can't access your safe deposit box to find your information. And anything digital will require MORE passwords to remember! And what happens to your digital files if your advisor changes firms or you change advisors?

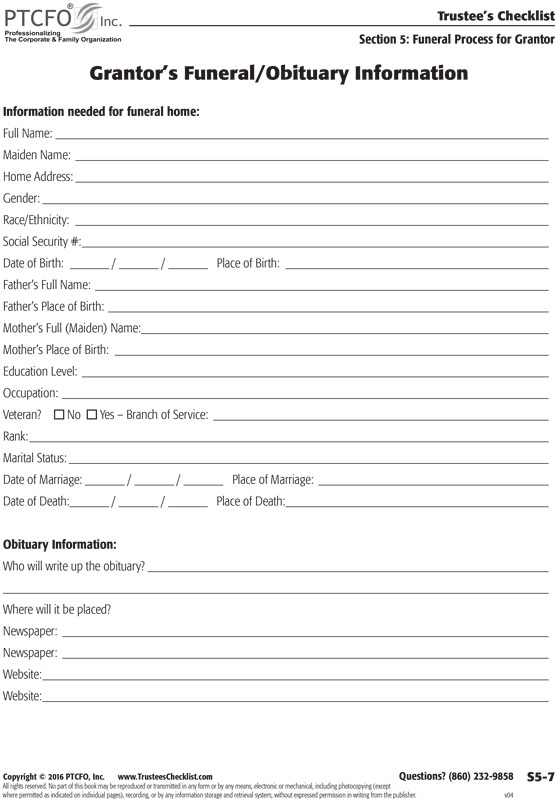

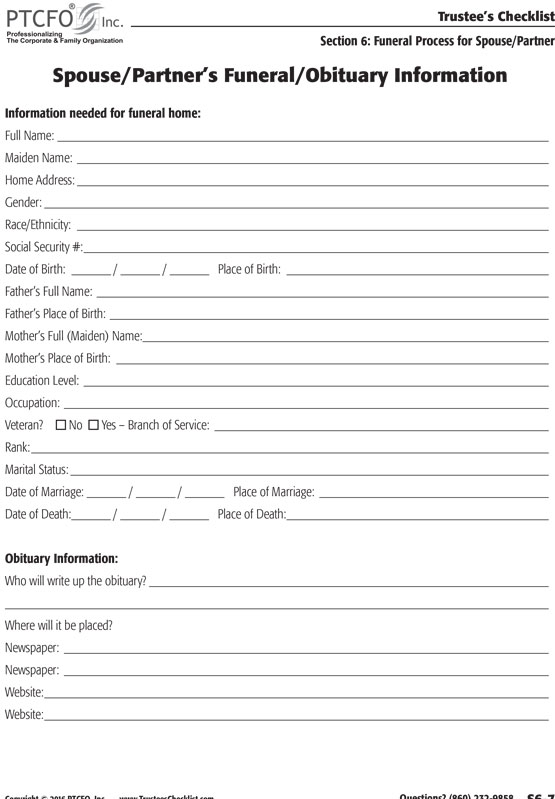

The Funeral Process Checklist

We have added our funeral checklist to help the Trustee work with the surviving family, or Executor manage the funeral process. Once the family completes the checklist, worries disappear!

Financial Documents

Keep all personal and financial information in an easy and sensible way: our checklist covers logins, passwords, bank, credit and loan statements as well as social media; all found in one safe and easy way to access a person's many secured websites.

Take a peek inside the Trustee's Checklist:

A limited preview of the book

Trustee's Checklist - one stop for all your crucial information

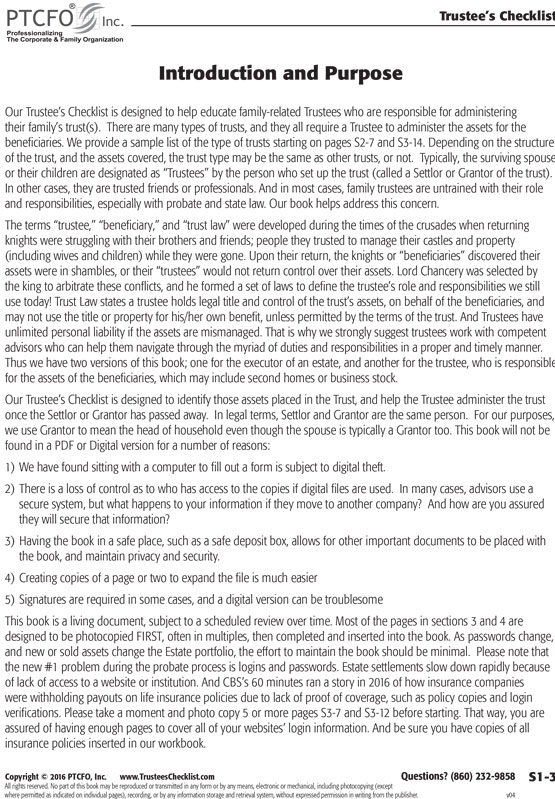

Our Trustee's Checklist is a legal repository that keeps all of the family trustee's crucial trust-related information in one place. Jack Veale developed this checklist over decades of working with families and helping family trustees who must deal with the details and fiduciary responsibilities for being a trustee. Jack's checklist started out as a 3 page spreadsheet integrated with the parents estate plans; gradually expanding the check list items to cover over 100 pages! For example, 15 - 20 years ago, having logins and passwords on bank accounts, social media, and other websites was not on the list. IPhones and Android software did not exist either. Today, the probate courts are struggling with logins and passwords as the deceased did not prepare others to gain access to their important sites, and the sites are refusing to give the family trustee access. The most important value for this process is to engage the spouses, family and key advisors to help the grantor train the trustee to minimize the stress typically found when trustees are unprepared for their fiduciary responsibility. Trustees, like Executors have serious personal liability when they become a trustee. We recommend parents and their family be guided by this checklist working while with their advisors.

From Jack's view, people typically avoid trustee training, as well as planning their own passing away, forcing the surviving family members to to make decisions unprepared and under extraordinary stress. How many times have you heard of a family running into trouble when the parent or child suddenly dies? Even the most famous can have this problem, such as the musician Prince, who died suddenly without a will or estate plan. The taxes and fees will be enormous! When parents completely fill out the funeral portion of our Trustee's Checklist, their family, executors and/or trusted advisors can follow the decease's intentions and quickly take the reins of the funeral and estate settlement process. By following the checklist, the surviving family leaders can stabilize family harmony, and improve the success for a family trustee. We typically find the cost of probate fees, especially in states like California, are far more expensive than the fees found working with trusted advisors in this process.

Our Trustee's Checklist is designed for estate planners and other key advisors to use our checklist to facilitate the discussions in an organized and thoughtful way. From Jack's view,the family's key advisors work in isolation and aren't allowed to coordinate well with other advisors. Jack developed this checklist to help engage other advisors as part of his business advisory process, while developing a comprehensive business succession plan, if the trust holds company stock as the primary asset. Our Trustee's Checklist helps trusted advisors coordinate with other advisors, and the family, to customize the estate planning process. The goal is for the Grantors to engage their advisors to develop a carefully and thoughtfully prepared funeral and estate plan, to help reduce the family's emotional and financial stress. It also designed to minimize the trustee's stress when the surviving family is suffering during the Grantor's funeral process. When fully and correctly completed, this book should minimize the family's emotional struggles with the hundreds of decisions and legal obligations required by the probate court and funeral process. The checklist can save thousands of dollars in probate costs and fees. In addition, a 60 Minutes news story covered how insurance companies can refuse to pay out benefits and keep the proceeds because the documentation was not available. Now is the time for getting your estate in order, using our checklist, to help your family and trustees, when you no longer are around to help them.

.Estate planners, including lawyers, wealth managers, accountants & other professionals: private-label our Trustee's Checklist for your clients

A number of financial advisors, accountants and other professionals have already used the Checklist as an invaluable tool to help their clients plan for the unthinkable.

Copyright note

Copyright © 2011, 2015, 2016 PTCFO, Inc.

All rights reserved. No part of this book may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying (except where permitted as indicated on individual pages in Sections 5 and 6), recording, or by any information storage and retrieval system, without expressed permission in writing from the publisher.